Malaysia’s First CRESS Carbon Credit Auction - How a new domestic market could turbo charge low carbon retrofits

- Admin

- Jul 28, 2025

- 7 min read

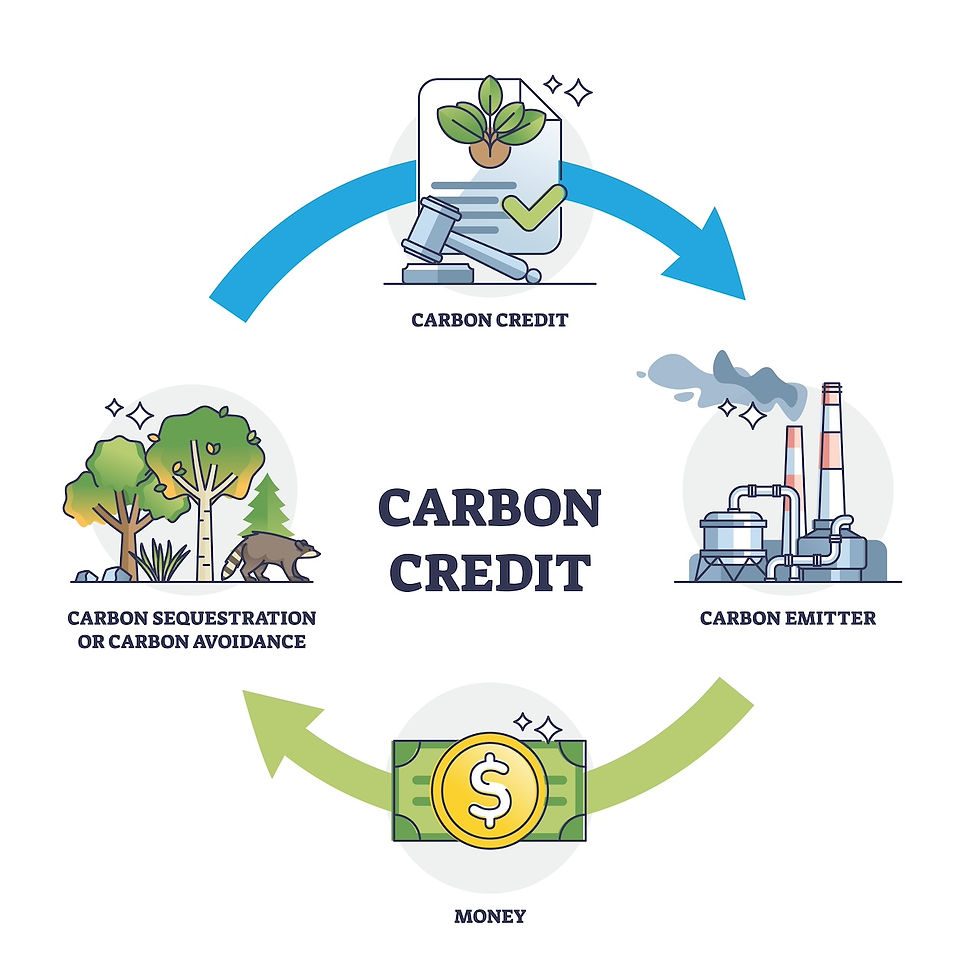

On 22 July 2025 Bursa Malaysia’s subsidiary Bursa Carbon Exchange (BCX) joined forces with renewable‑energy developer UEM Lestra to roll out Malaysia’s first auction under the Corporate Renewable Energy Supply Scheme (CRESS).

The pilot sale, pencilled in for November 2025, will let businesses place one bid that secures two things at once:

A multi‑year supply of clean electricity generated inside Malaysia;

A digital certificate that proves how much carbon dioxide was kept out of the atmosphere because that electricity replaced fossil‑fuel power on the national grid.

For factory owners, hotel operators, and real‑estate investors, the auction promises a ringgit‑denominated price for every tonne of CO₂ they avoid. That creates a brand‑new local revenue stream for energy‑saving projects, shortens the payback period on green retrofits, and keeps all the economic benefits inside Malaysia’s banking system instead of sending money to overseas offset registries.

CRESS in Plain English

Think of CRESS as a public power‑purchase agreement with a carbon twist. Instead of a private deal between one generator and one corporate buyer, the Energy Commission gathers blocks of renewable‑energy capacity and auctions them on BCX’s online trading platform. Winners receive a Bilateral Energy Supply Contract (BESC) that locks in a kilowatt‑hour price for up to ten years. Every megawatt‑hour delivered is automatically linked to an official grid‑emission factor (the amount of CO₂ normally produced to generate that electricity). BCX bundles these avoided tonnes into CRESS certificates and deposits them in the buyer’s digital wallet.

Because the grid factor is calculated and signed off by regulators ahead of time, project owners do not need to hire overseas auditors or wait eighteen months for verification, as they would with traditional voluntary carbon credits. Smart meters measure the electricity, BCX clears the trade, and certificates appear in the buyer’s account, often within weeks of generation. The shorter cycle slashes paperwork eliminates currency risk, and crucially keeps climate‑finance dollars circulating in the local economy rather than exporting them to a foreign registry.

How does a CRESS certificate differ from a standard Verra credit?

Aspect | CRESS certificate | Typical Verra credit |

Origin | Malaysian grid‑connected renewable project | Global forestry, renewable or household projects |

Trade unit | 1 MWh of green electricity plus its avoided‑carbon claim | 1 t CO₂‑e reduced or removed |

Oversight | Energy Commission + Bursa Malaysia | Private registry + third‑party auditor |

Currency | Malaysian ringgit | Mainly US dollar |

Wait time | Weeks after power is produced | 12–24 months after project completion |

Main use | Scope 2 reporting for Malaysian operations | Global net‑zero claims |

Put simply, CRESS is fast, local, and tailor‑made for companies whose main footprint is inside Malaysia. Overseas credits will still matter for multinationals with far‑flung supply chains, but home‑grown firms finally get an option that speaks their language both legally and financially.

Milestone Timeline

Date | Milestone | Why it matters |

22 Jul 2025 | Memorandum of Collaboration signed between BCX and UEM Lestra | Kick‑starts the pilot process and confirms top‑level backing |

Aug–Sep 2025 | Roadshows in Penang, Kuala Lumpur, and Johor Bahru | Bidders learn auction rules; feedback fine‑tunes final terms |

15 Oct 2025 | Malaysia Carbon Market Forum | Government announces lot size, reserve price, and settlement method |

Nov 2025 | Pilot CRESS Auction opens on BCX | First chance to discover a domestic carbon price |

Q1 2028 | UEM Lestra’s 1 GW hybrid‑solar plant reaches commercial operation | Physical power delivery starts; certificates begin to flow |

A clear roadmap matters because businesses need time to line up board approvals and budget allocations before they can bid. The three‑month window between final bid terms and auction day is intentionally designed to give finance teams time to model impacts on electricity costs and sustainability targets.

Bursa Carbon Exchange at a Glance

Launched in late 2022, Bursa Carbon Exchange is the world’s first Shariah‑compliant marketplace for buying and selling carbon credits. It serves two core functions:

Auction‑as‑a‑Service (AaaS). BCX designs, hosts, and settles one‑off sales for new carbon products. The debut AaaS event in March 2023 cleared 150 000 tonnes of rainforest‑protection credits at prices ranging from RM 18.50 to RM 68.00 per tonne.

Continuous Spot Market. A live order book where verified carbon contracts change hands much like commodities on a futures exchange.

A follow‑up tech‑removals auction in June 2025 sold 70,000 tonnes at an average of RM 31 per tonne. These numbers show that Malaysian corporates will put real money behind climate goals when the instrument is well structured. CRESS now becomes the third flagship product on the platform, but the first to tie carbon directly to locally generated electricity. Because BCX already handles settlement for Bursa Malaysia’s equities and derivatives, the exchange can reuse existing KYC and clearing infrastructure, keeping transaction fees low for corporate buyers.

Meet UEM Lestra, the Supply Anchor

UEM Lestra is the clean‑energy spearhead of infrastructure heavyweight UEM Group, itself wholly owned by sovereign wealth fund Khazanah Nasional. The company’s flagship project is a 1‑gigawatt hybrid‑solar farm in Segamat, Johor, equipped with fixed‑tilt photovoltaic panels, a 200 MWh lithium‑iron‑phosphate battery, and a small run‑of‑river hydro station to smooth output during cloudy afternoons.

Engineering studies estimate that once the plant reaches full capacity in 2028 it could displace roughly 800,000 tonnes of CO₂ every year, equivalent to removing more than 170,000 petrol cars from Malaysian roads. That sort of volume is vital for a healthy auction: thin supply scares bidders and drives up volatility, whereas a deep book of certificates encourages long‑term offtake deals and stable pricing.

Lestra has promised transparent Measurement, Reporting and Verification (MRV) protocols aligned with ISO 14064; it will publish monthly generation data and grid‑emission factors on a public dashboard, making each tonne traceable from turbine to trading screen.

Policy Backdrop

Malaysia has promised a big cut in national emissions, and the energy sector carries most of the weight.

45 % lower carbon intensity by 2030 versus 2005. That pledge is locked into the country’s updated Nationally Determined Contribution (NDC) under the Paris Agreement.

70 % renewable capacity by 2050. The National Energy Transition Roadmap (NETR), published in 2023, makes this the headline target and bans any new coal plants.

What the roadmap did not spell out was a way for everyday companies like a hotel chain or a packaging factory to turn their own carbon savings into cash. CRESS fills that gap. Because the certificates are priced in ringgit and governed by local law, they cleanly plug into tax incentives such as the Green Investment Tax Allowance (GITA), green sukuk guidelines, and state‑backed loan guarantees.

The policy logic is simple:

Build more renewable power.

Put a domestic price on avoided emissions so private firms help pay for the build‑out.

Keep the money and the emissions cuts inside Malaysia’s balance sheet, which is vital when the government starts drafting its planned Climate Change Act in 2025

Why the Auction Matters for Real‑Estate Retrofits

Immediate price discovery

When you know the clearing price for a tonne of CO₂ inside Malaysia, you can calculate the extra income a retrofit will earn before you spend a single ringgit on new equipment. That makes board approval faster and cheaper.

Shorter monetisation cycle

Traditional voluntary credits must pass a three‑step process: validation, verification, and issuance. Even a simple LED‑lighting upgrade can wait up to 24 months for its first sale. Under CRESS the emissions factor is already approved. The moment a smart meter shows a kilowatt‑hour savings, the avoided tonnes can be minted and sold, often in 30–45 days.

Hedge against energy‑performance‑contract (EPC) risk

EPC firms guarantee a percent reduction in the utility bill and get paid from the savings. If a domestic carbon floor price sits under that revenue, contractors can offer lower performance‑risk premiums, bringing down the total retrofit bill.

Numbers that matter – use the table below

Malaysia’s latest official grid‑emission factor for Peninsular power is 0.774 t CO₂ per MWh (2022). Using that figure, here is what a medium‑size project could earn:

Building type | Annual electricity saved | CO₂ avoided | Credit value @ RM 30/t | Credit value @ RM 60/t |

12 000 m² office (LED + chiller upgrade) | 1.3 GWh | ≈1 000 t | RM 30 000 per year | RM 60 000 per year |

80‑room heritage hotel | 650 MWh | ≈500 t | RM 15 000 | RM 30 000 |

Mid‑rise condo (common‑area solar) | 400 MWh | ≈310 t | RM 9 300 | RM 18 600 |

Even at the lower end of the price range, those credits can shave 5–10 % off the payback period of a typical RM 1 million retrofit.

Market Voices

“We are building a platform where local emissions reductions carry the same financial weight as any global credit, but with Malaysian governance.” — Datuk Fad’l Mohamed, CEO, Bursa Malaysia, at the signing ceremony.

“Corporates can now lock in clean electricity and meet their ESG targets in a faster, simpler way.” — Harman Faiz Habib Muhamad, CEO, UEM Lestra.

These remarks highlight two take‑aways: transparency builds trust, and speed to market matters as much as headline price.

Risks & Watch‑Points

Risk | Why it matters | Mitigation idea |

Auction delay | The pilot date is “tentative”; slippage would push price discovery into 2026. | Monitor the 15 Oct Carbon Market Forum and keep retrofit finance flexible. |

Credit quality debate | Critics may claim grid‑emission factors are not “additional”. | Publish third‑party energy‑audit data and show net‑metering records. |

Future overlap with an ETS | If Malaysia launches an Emissions Trading Scheme, double‑counting must be avoided. | Ensure BCX registry flags retired CRESS units as non‑fungible with any future ETS. |

Next Steps & Mymland Take‑away

What Mymland can do in the next 90 days

Baseline audits – Engage an energy‑services company to measure existing loads at three Kuala Lumpur properties.

Legal check – Add a clause in tenant agreements assigning the right to claim avoided‑emissions revenue to the landlord.

BCX onboarding – Submit KYC documents ahead of the November auction.

If the clearing price lands at or above RM 40/t, Mymland could unlock a domestic credit stream worth tens of thousands of ringgit per project without the 18‑month lag and higher fees of overseas offsets. That extra cash shortens the payback timeline and strengthens the investment case for deeper energy upgrades in later project phases.

Final Thoughts

Malaysia’s first CRESS auction signals a clear shift: carbon savings generated at home can now earn real, ringgit‑denominated revenue. By linking clean‑power supply directly to tradable certificates, BCX and UEM Lestra have created a fast, transparent route for businesses to turn efficiency projects into cash while supporting the nation’s wider energy‑transition goals. For developers and property owners, the message is simple, measure your energy use, plan your retrofits, and be ready to bid. The sooner you lock in local credits, the sooner your balance sheet reflects both lower emissions and stronger returns.

Comments